Budgeting For a Family

What do you know about Budgeting for a Family? Planning is a vital part of monetary administration and with regards to a family. It takes on considerably more noteworthy importance.

Budgeting for a family, Making and adhering to a spending plan can assist your family with accomplishing monetary objectives handle unforeseen costs and construct a protected future.

Summary

Planning for a family is a proactive monetary administration procedure with the two benefits and difficulties. (Budgeting for a family) The stars incorporate acquiring monetary control accomplishing explicit objectives planning for crises, overseeing obligation successfully, cultivating monetary mindfulness and advancing reserve funds and ventures. the general objective of family planning is to lay out an organized monetary arrangement that upgrades dependability, lessens pressure and empowers the family to pursue both present moment and long-haul monetary goals.

Evaluate Your Funds for Budgeting for a family

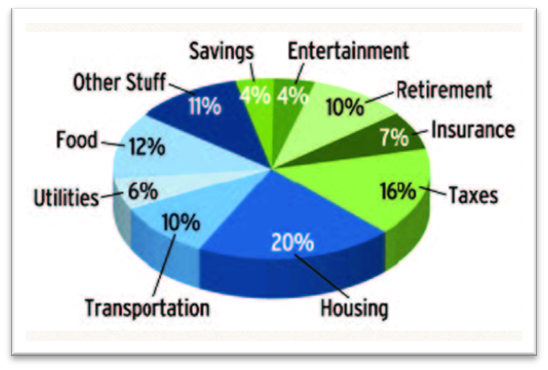

Start by assessing what is happening. Check out your pay including all sources like pay rates, rewards, and different types of income.

Moreover, archive your month-to-month expenses, including fixed costs like lease or home loan, utilities and protection as well as factor costs like food amusement and optional spending.

Put forth Clear Monetary Objectives

Decide both present moment and long-haul monetary objectives for your loved ones. These may incorporate putting something aside for an excursion, purchasing a home, financing your youngsters’ schooling, or planning for retirement.

Having clear cut objectives will give guidance to your planning endeavors and persuade your family to stick to the arrangement.

Make a Sensible Spending Plan

In light of your pay and costs create a practical spending plan that lines up with your monetary objectives.

Dispense assets for fundamental costs first and afterward appropriate the excess pay among your monetary objectives and optional spending.

Make certain to leave space for investment funds, crises and obligation reimbursement.

Focus on Saving

Saving is a foundation of any compelling spending plan. Lay out a just-in-case account to cover unforeseen costs. for example, doctor’s visit expenses or vehicle fixes.

Furthermore, contribute consistently to bank accounts for explicit objectives, similar to training or an initial installment on a home. Robotize your reserve funds to guarantee consistency.

Track and Screen Spending

Consistently track your spending to guarantee you are adhering to your financial plan. Use planning applications or accounting sheets to record and arrange costs.

Intermittently survey your ways of managing money and change your spending plan if important. Recognizing regions where you can scale back can assist you with remaining focused.

Include the Whole Family

Make planning a family undertaking by including everybody simultaneously. Talk about monetary objectives with your mate and kids making sense of the significance of planning and saving.

Support open correspondence about monetary issues to cultivate a feeling of shared liability.

Plan for Obligation Reimbursement

In the event that your family has exceptional obligations make an arrangement for reimbursement. Focus on exorbitant interest obligations and work towards disposing of them.

(Budgeting for a family) Consider obligation solidification or renegotiating choices to lessen loan costs and make reimbursement more sensible.

Audit and Change Routinely

Life is dynamic and your monetary circumstance might change after some time. Routinely survey your financial plan and make changes depending on the situation.

Changes in pay, costs, or family conditions might expect alterations to your monetary arrangement.

Pros and cons of Budgeting for a Family

Pros

Planning gives a reasonable outline of pay and costs, offering families more prominent command over their funds. It helps in trying not to overspend and guarantees that cash is distributed effectively.

Families can set and pursue explicit monetary objectives. Whether, it’s putting something aside for an excursion buying a home or financing instruction. Planning focuses on these objectives and track progress.

Making a backup stash is a central part of planning. Families with a spending plan are more ready to deal with surprising costs. for example, health related crises or vehicle fixes without crashing their generally monetary arrangement.

Planning permits families to apportion assets for obligation reimbursement assisting with overseeing and kill extraordinary obligations. This proactive way to deal with obligation can prompt superior monetary wellbeing over the long run.

Planning encourages monetary mindfulness and obligation inside the family. It empowers open correspondence about cash matters guaranteeing that all relatives are in total agreement with respect to monetary choices.

Cons

Making and keeping a spending plan can time-consume. It requires customary updates following of costs and progressing correspondence inside the family.

While planning gets ready for surprising costs Families could in any case confront difficulties when stood up to with major unforeseeable monetary issues.

Relatives could at first oppose planning, particularly on the off chance that they see it as prohibitive. Conquering this obstruction and getting everybody on board can take time and exertion.

Severe adherence to a spending plan can be testing particularly whenever confronted with enticements or startling open doors. Families might battle with keeping up with discipline possibly undermining their monetary objectives.

Some planning techniques can be inflexible making it hard to adjust to evolving conditions. Life altering situations like employment misfortune or health related crises may expect changes in accordance with the financial plan that are not effectively obliged all of the time.

Extreme spotlight on planning might prompt a lopsided accentuation on cash inside the family. Finding some kind of harmony between monetary obligation and getting a charge out of life is essential for in general prosperity.

Conclusion

Planning for a family is a proactive and enabling method for assuming command over your monetary future. By making a practical spending plan, defining clear objectives and including the whole family.

Instantaneously, you can fabricate an establishment for monetary soundness and guarantee a protected future for your friends and family.

(Budgeting for a family) Keep in mind, consistency and versatility are key as you explore the monetary excursion together.